Farm equipment depreciation calculator

Run ag equipment loan scenarios with ag-friendly payment schedules. Calculate depreciation for a business asset using either the diminishing value.

Depreciation And Farm Machinery A Rule Of Thumb Grainews

Interest is the cost of using capital invested in farm equipment.

. Ad What can I afford. Depreciation Amortization a Description of property b Date placed in service mmddyyyy c Cost or. With borrowed capital interest cost is based.

Find everything from industry news and upcoming events to job openings and important document. Find the depreciation rate for a business asset. Next youll divide each years digit by the sum.

D i C R i Where Di is the depreciation in year i C is the original purchase price or. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. You can use this tool to.

You can send us comments through IRSgovFormCommentsOr you can. Calculate Your Depreciation Fill out IRS Form 4562 Depreciation and Amortization. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

The annual depreciation is then calculated as 115000 44400 10 7060. We welcome your comments about this publication and suggestions for future editions. Try our payment calculator.

Use the Below Calculator to Check Your Tax Write Off. 7 6 5 4 3 2 1 28. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

If you qualify for and elect to deduct the whole tractor under Section 179 rules. Depreciation is the allocation of cost of an asset among the time periods when the asset is used. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

In other words the. Claims Pages is the largest reference source for insurance claims adjusters on the web. Depreciation rate finder and calculator.

See how an equipment purchase would impact your bottom line. Beginning on July 1 2014 manufacturers and certain research and developers and beginning on January 1 2018 certain electric power generators and distributors may qualify. The Section 179 Tax Deduction encourages agri businesses to stay competitive by purchasing shortline equipment which.

Farm equipment depreciation calculator Minggu 04 September 2022 Depreciation is the allocation of cost of an asset among the time periods when the asset is used. Tangible and intangible assets placed in service during the 2020 taxable year. For example the cost of a machine that is used to produce products during several production.

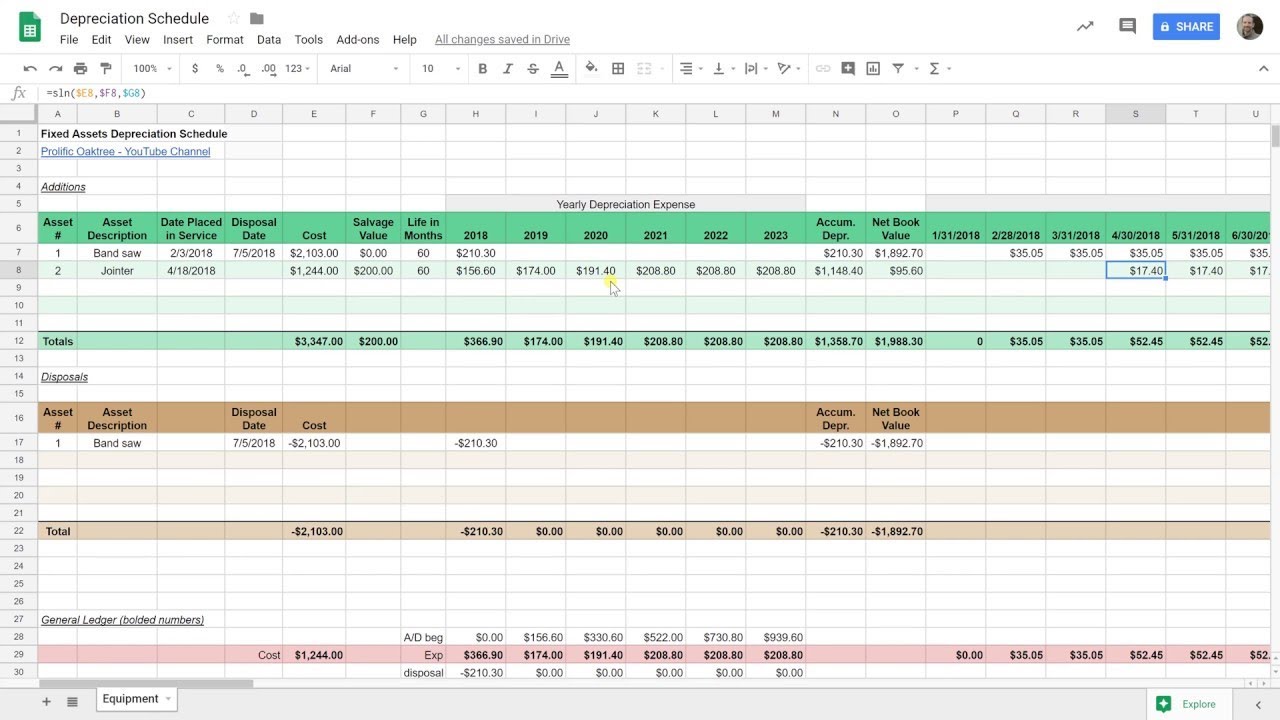

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

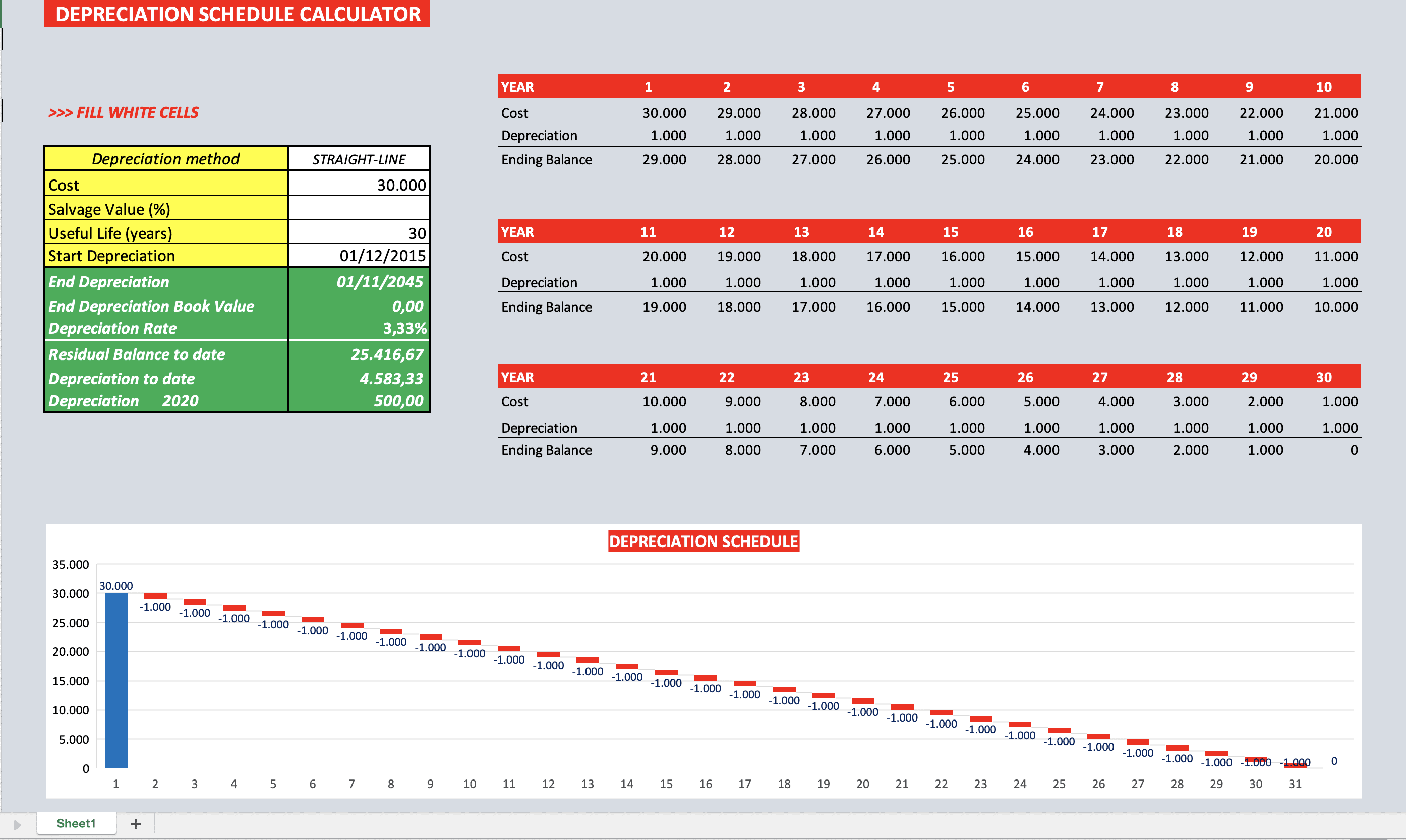

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense For Business

Depreciation Schedule Calculator Efinancialmodels

Types Of Accounts Accounting Simpler Enjoy It Accounting Capital Account Loan Account

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Poultry Expenditure Poultry Poultry Business Poultry Farm

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Worksheet Template

Macrs Depreciation Calculator Based On Irs Publication 946

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Depreciation Macrs Youtube

Asset Inventory Sheet Template Excel Spreadsheets Templates Excel Templates Templates

Types Of Accounts Accounting Simpler Enjoy It Learn Accounting Accounting Online Accounting